Thank you to all who attended this webinar which was recently concluded on 14 June 2022! For those who missed the webinar, as always, here’s an article that summarises the key points of the webinar. The webinar was broken down into the following segments: The ecosystem and shift in roles of its players Being nimble… that is where intermediaries and insurers can place technology in the middle of their relationship – technology can then provide robust data, management systems and automation to allow for efficient and accurate sharing of information. Essentially, technology will always remain a blank bullet if intermediaries choose to mute their advisory skills while insurers choose not to share their expertise and understanding of risk management. However, if everyone chooses to ‘play ball’ in a digital ecosystem, the benefits are tangible An inclusive culture; breaking down silos While ‘digital transformation’ is the term hanging on everyone’s lips, what is potentially even more important is ‘cultural transformation’. Technology allows for business and the ecosystem to be run with greater flexibility and less inertia to adapt to changes – however, technology alone will not be able to change mindsets. At the end of the day, the policyholder needs to always be placed top-of-mind. To retain the loyalty and ultimately, purchase preference of the customer, the parties that can build the strongest value proposition – be it in terms of the level of customisation allowed for a product by an insurer, or the level of expert advice provided by the intermediary – will win. Bespoke vs packaged products Crafting a product or policy involves multiple factors and nuances. One of which is the ease of risk calculation and claims fulfilment – the benefits of selling packaged policies are clear… It is a ‘one size fit all, one system solves all’ model. This helps with scaling and ease of distribution. The downside of packaged products, as with every other packaged product or ‘set meal’, is that not everything within this package is required by the insured. To a certain extent, and arguably, some are forced to take up coverage that they obviously do not need, for the purpose of obtaining one that they do. Technology is here to help unlock this shift; to enable disbursement of bespoke policies. Rise of digital insurance marketplace A digital insurance marketplace is emerging, fueled by technological advances and rising interest among intermediaries for faster, cheaper and more adaptable ways to meet their risk-management needs. Simply put, an insurance marketplace is a digital ecosystem that enables carriers, customers, agents, brokers and even non-insurance participants to seamlessly connect with each other, thereby transforming the way insurance products are distributed and purchased. The marketplace can create economic benefits for participants, spark innovation and improve price transparency For insurers, a marketplace allows them to gain access to a larger customer base through a digital distribution channel Digital ecosystem and a new role for the insurer A digital ecosystem envisions a new role for insurers, one that can exist alongside their traditional functions. Insurers have long played a central role in the insurance ecosystem by developing distribution channels, managing captive agents and brokers and coordinating complementary service providers – a process that can be complex and costly to operate. In a digital ecosystem, the carrier is a participant, working alongside other organizations to provide a seamless, one-stop experience for customers. Investing in digital transformation Many insurers are building the foundation for this new role through their digital investments. Deloitte’s 2021 survey of insurance executives found that 95% were already accelerating or looking to speed up their digital transformation. Among the priorities for investment they cited were ‘digital channels’ The 7 stages of a decision making process At the webinar, stages 1, 2 and 5 was touched upon further Stage 1: Identify the decision to be made This is the stage where the client is prompted to think about insurance needs. At this stage, the client has consciously or subconsciously come up with a problem statement of which he needs to make a decision to solve. This is where you help the client uncover the needs in relation to the problem statement. Stage 2: Gather relevant information This stage is where the client does a little bit of self assessment and education. The client will likely look to do so on two levels. One is on the internal level where they ask themselves a series of questions – things like ‘what would give me a peace of mind?’, ‘what are bare essentials and what are good-to-haves?’ The other is external. This is where they find external sources to educate themselves. In asking the right questions, you are effectively influencing the internal thought process Stage 5: Choose among alternatives You should not take this stage as a done deal This is the stage where you present the power of your knowledge from the questions you have asked… Tangibly, this would be the kinds of quotes that you are able to get and how closely they fulfil the needs and why. Optimism bias What? What has it to do with insurance? Even with fear, sometimes, the brain gets a little tangled up… In a survey by yougov, it was asked if respondents ear death or Covid-19 more Why? What has it to do with insurance? Technology will not be able to replace the ‘spark’ to get clients to think about insurance proactively. Our brain is just not tuned to WANTING insurance! Have you ever bought something and then regretted it? That is buyer’s remorse! Depending on the value and importance of the purchase, this could be the worst feeling ever. Ultimately, insurance is meant to give your clients a peace of mind; you care about the client and want them to feel confident in the deal The time and effort you spend on after-sales service is as crucial as that, during the sales process. At the webinar, some tips where shared to help nip any of such occurrences in the bud. Layout the options for the client Having a clear idea of the majority of his options available, they will know that when they sign that they are doing so, eyes-wide-open, and had the pick of the cherry For GI, an example of this would be to go the extra mile and source for multiple quotes for your clients to pick from. From there, you can provide your advice and opinion on which one they should go with. Let your clients know you care Let your client know that they are not merely your means to an end and actually putting in the effort to cultivate a good foundational relationship. When your client trusts in you and your advice, even when the buyer’s remorse creeps in, they can actually look to you as their ‘pillar of confidence’ Set expectations Lay out when and what the client can expect from the moment they commit. For example, a simple breakdown of the process of when they can sign the policy, when the policy will take effect etc. Keeping to timelines is the same as keeping your promises – this is part of the trust building process that will ultimately prevent buyer’s remorse! Staying hungry Hungry for more success. Hungry to serve their clients better. Hungry for ways to improve their current business processes. When times are tough the less successful agents always retreat back into their comfort zone and the safe haven of ‘how it has always been’ Willingness to fail LEARN from failings. Highly effective agents believe failure is another step on the road to success. Instead of shying away from failure, they embrace their misses, learn, adapt and try again. Be keen to try out new ways to enhance business processes instead of avoiding the prospect of failure and settling instead with being mediocre. Being available and quick to respond Being available is not just answering the phone call or responding to the text in a timely manner. It is also about the follow-up work you do thereafter all the way through till it is done; to be more efficient in following up on their client’s requests. Highly effective insurance agents have begun to embrace the idea of digitising their business and leverage tech solutions. We no longer live in a world where we as insurance agents can dictate the terms of communication with our clients. Being value driven There is a difference between getting it done and getting it done WELL. A lot of times, this means genuinely seeking the best policy for the client. Whether. The. client. Knows. It. or. Not. Rather than pushing a deal that gets the best returns, many successful agents we have spoken to put in the extra effort to source for the best quotes / coverage, at times, even if it means referring them to another agent who can get their client a better deal. Surrounding yourself with like-minded people Success breeds success. Always keep your inner circle to those who are highly motivated and brings out positivity in you. This has nothing to do with being elitist. “Imagine if you work with someone who just keeps telling you to chill, let’s go for beer. You run the risk of eventually going for that beer instead of persevering!” one of the agents we spoke to shared. The importance of asking the right questions is just the frame to the broader picture associated with being curious to understand the client and to serve them better as an advisor Most powerful question – asking the client their propensity to change Example: For a client who already has an existing policy… If the answer you get is a ‘oh actually, it’s best but at a lower price lah’; now you understand it is more a budget issue than a new set of requirements. If the answer you get is a ‘Yes. I don’t think my existing policy can cover the 2 other new restaurants I intend to open…’; here you understand that the client’s needs are driven by business expansion. This question goes deeper than ‘what are your needs?’. ‘What are your needs?’ requires the client to list what he thinks is good / suited However, this might not actually be the best answer to get. What if the client has a lack of understanding of what the possibilities are? By asking the client what prompted them to start exploring, you are essentially asking the client to explain the ‘why’ not the ‘how’ or ‘what’ – that is your job! From this point, you can then ask more specific questions to fully understand what kind of policies will best work for the client AND NOT what the client think it best – you are the PRO! Once you have ‘opened the door’, you can now jump into the nitty gritty or the details of what the client needs… Understanding context Responding to your clients and show that you understand their situation. If a client has just suffered a personal tragedy, would you end your conversation with a sign-off that says ‘Cheers!’? Similarly, would you harry your clients and talk business if they are in a difficult period? Ability for flexibility and empathy Clients of the near future will understand that digital platforms are still ‘pre programmed’. So, when they interact with a human, they expect the human to be exactly that! Bots Human Helping them understand what they need Some example of questions that a human would ask to help both parties uncover needs: What prompted you to start exploring? Follow-up questions Being conscientious DON’T LEAVE YOUR CLIENTS HANGING Even in cases where you are in the midst of solving your client’s issue Drop them a note If you know you will need a little time before you can even look at whatever issue Drop them a note If the issue has been resolved, do not assume the client is just sitting there checking at every instance. Drop them a note TQ is as important as IQ and EQ TQ = Technology Quotient The ability to adapt to technological changes The ability to develop and employ strategies to take advantage of technology in work and life Wow customers with your savviness: We are all exposed to some form of tech, your clients as well Show how you organise work to take full advantage of available technology This is not a matter of genes but that of attitude! It is training yourself to be receptive to adapt and flourish to advancement We were not forced to learn how to use smartphones, the computer or the internet; so we should not be worried at the prospect of learning to leverage tech! Ask for and ACT on feedback Nothing is more valuable than feedback; if taken onboard with the right mindset When the client takes the time to give you their feedback, be sure to set expectations and then walk the talk! Not everything can be fulfilled, but if you are able to set expectations and then stick to whatever commitments, it really will go a long way. Be transparent If an issue really happened, make sure to Honesty, in our opinion, is always the best policy Delight clients even when you don’t have to A big element of delighting a client is when they least expect it. Be prepared to help clients, post-sale This is where intermediaries are the most reassuring to their clients. Help the client get more clarity on the process – you will come across as a pillar of assurance that things will be okay. Help the client problem solve or help them make decisions with confidence. — Thank you to those who took time out to join us at the webinar. We hope it was a fruitful session for you. For those who are reading our highlights because you couldn’t make it, we hope this article gave you a good summary of the content shared! Subscribe to our Telegram channel or stay tuned to our Facebook or LinkedIn pages to get updates on more of such initiatives! It is fuss-free. No credit card or payment required.Key highlights

Tech and the insurance ecosystem

Rethinking the insurance proposition and the role each party in the ecosystem plays

The intermediaries will always play the most important role as an advisor to the client – he should be empowered to be able to fully understand the client’s business needs and advise accordingly, instead of just presenting available packaged options.Not just intermediaries but insurers are rethinking their role as well

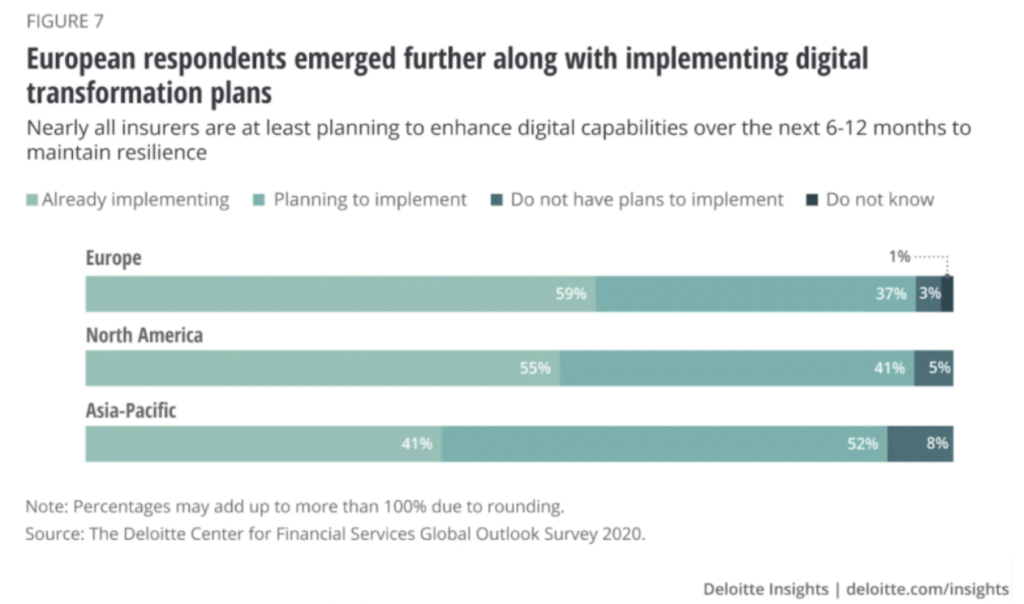

Source: deloitte.com/insights

Source: deloitte.com/insights Understanding your client’s mindset

Understand the client’s decision making process

Fear and optimism bias

Buyer’s remorse

Key habits intermediaries can cultivate

6 Habits of highly effective Insurance agents

Being curious about your client helps you uncover needs and remove objections

Magic question 1: How willing are you to change?

Magic question 2: What prompted you to start exploring?

Magic questions 3 – 6: Targeted follow-up questions

Soft skills that remain relevant in this digital world

Customer Interaction

Interpersonal skills

Are you an Insurance intermediary? Sign up for free now!

Subscribe to our Telegram channel to get the most insightful articles delivered to you automatically!